·

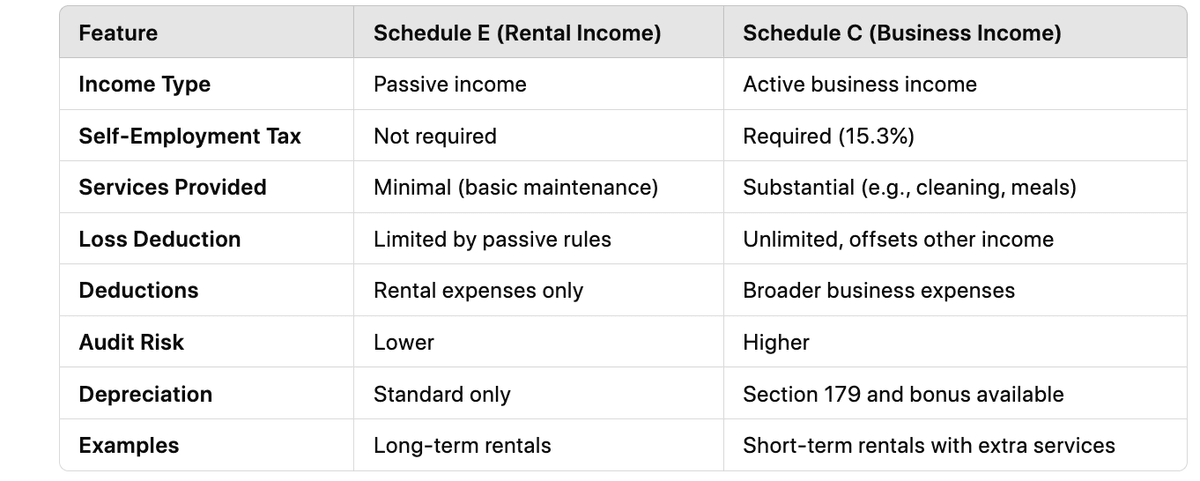

You may be wandering if your rental or airbnb qualifies for a Schedule C (profit/loss from your bsiness) or a Schedule E (supplemental income and loss). This post will hopefully clarify which Schedule you qualify for.

Schedule C: Profit or Loss from Business

Schedule C is typically used by sole proprietors and independent contractors to report income and expenses from a trade or business. If your property-related activity is considered an active business, such as a short-term rental or Airbnb, you may need to file Schedule C.

When to Use Schedule C

- You actively provide substantial services to guests (e.g., daily cleaning, meals, concierge services).

- The property is rented out on a short-term basis, usually averaging less than 7 days per tenant.

- You operate the property as part of a trade or business with the intent to earn a profit.

Schedule E: Supplemental Income and Loss

Schedule E is used to report passive income from rental properties, royalties, and other supplemental income sources. If your property is rented out with minimal involvement, Schedule E is likely the correct form.

When to Use Schedule E

- The property generates passive rental income.

- You do not provide substantial services beyond what is customary for landlords (e.g., basic maintenance and repairs).

- Tenants typically stay for longer periods (e.g., monthly or yearly leases).